In Georgia, with some exceptions, the opposing party a/k/a the defendant must be “personally” served before a lawsuit can go forward. This means the lawsuit must be physically handed to the defendant. If the defendant is a corporation, service is made on the corporation’s registered agent. (Every corporation in Georgia is required to appoint a registered agent—this information can be found on the Georgia Secretary of State’s website.)

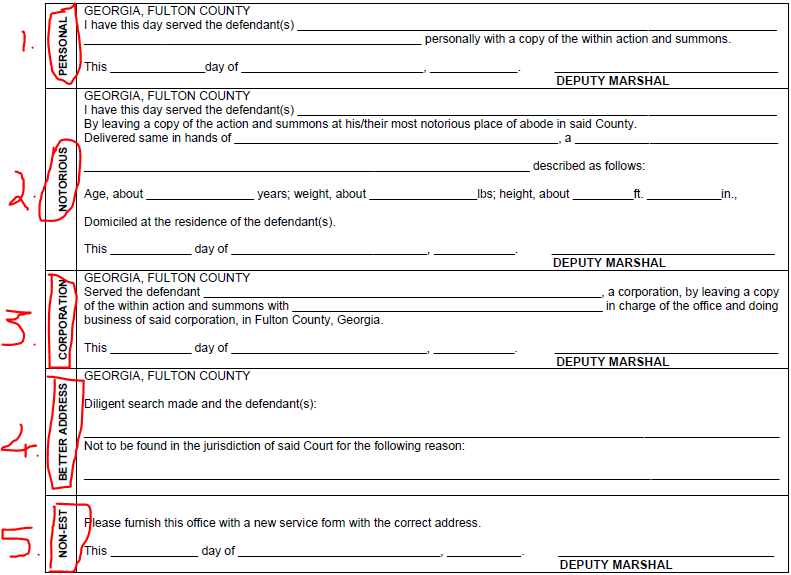

Service usually begins by providing the sheriff a copy of the complaint, summons, and sheriff’s entry of service form. Service by the sheriff typically takes two to three weeks, during which time a sheriff’s deputy will complete the form and mail it back to the filing party. What does this form mean? Below is the relevant part of the form and how we address the various types of service in our office:

If the “personal” box is completed (box # 1 above), almost always, the sheriff has handed the paperwork to the opposing party and service is complete. Now we can get to work on the case.

If the “notorious” box is checked (box # 2 above) this means the sheriff has handed the paperwork to someone over 18 years old who lives the opposing party. Georgia law allows notorious service, but, in our experience, we should be cautious in these situations because notorious service is sometimes unreliable and can challenged. Fortunately, an answer is due from the opposing party 30 days after service. If service isn’t contested in the answer, we no longer need to worry about service. If service is contested in the answer and seems reasonable, we will discuss with you the merits of repeating service. Ultimately, getting proper service is important because if we don’t have proper service, any judgment we obtain might be overturned.

The “corporation” box (box # 3 above) obviously applies to serving a corporation. If this is checked, generally, this ends up being successful service.

If the “better address” box is checked (box # 5 above) this means the person living at the address provided has told the sheriff that opposing party has moved.

Finally, the dreaded “non-est” box box # 5 above): this means the sheriff has gone to the address provided but was unable to serve the defendant. Most importantly, this means the lawsuit can’t continue. At this point, we need to determine if we have a good address for the opposing party. A defendant can be served at home, work, church, etc. If we are confident we have a good address despite the sheriff being unsuccessful, we recommend hiring a private process server. Unlike the sheriff, a private process server will work with us and has a much better chance of successfully serving the defendant. The cost for a private process server is about $100, but goes up depending on difficulty. If we aren’t confident that we have a good address, we recommend hiring an investigator to find a good address for the defendant. This is more expensive and will cost $250 and upwards.

If we still can’t find the defendant or believe the defendant is avoiding service, we’re entitled to ask the court to allow us to serve the opposing party by publication. We’ll address service by publication in a separate blog.

We hope this gives you a better idea regarding service of a lawsuit in Georgia. If you have any questions, please don’t hesitate to call us at 404-382-9994.