The title of this blog encompasses three differing but often overlapping areas of Georgia law. The Georgia Court of Appeals decided a case involving all three: quiet title, adverse possession, and color of title. See Brownphil, LLC v. Cudjoe, __ Ga. App. __ (March 14, 2024, A23A1762).

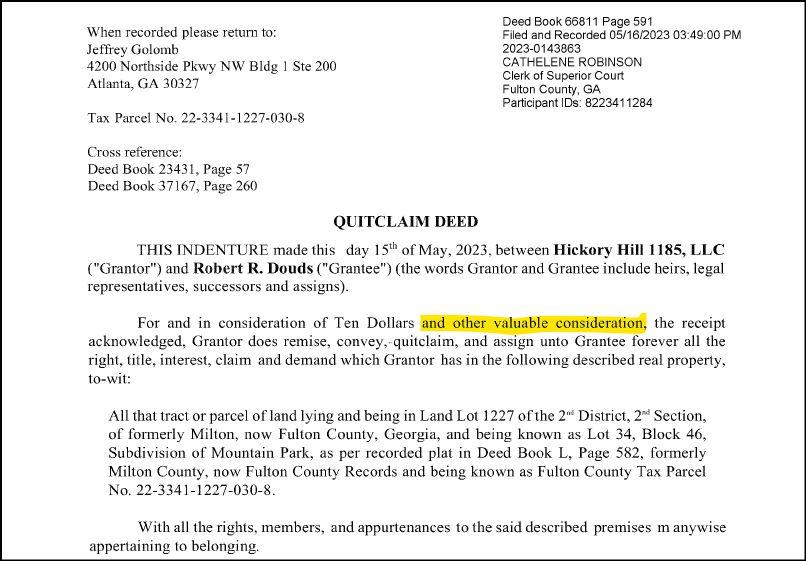

To understand the case, we have to quickly review the title history. The property was obtained by Earnest and Louise McClendon in 1958. They conveyed their interest to Grier Construction Company (owned by Freddie Grier). In 1997, Freddie Grier—not Grier Construction—conveyed the property to Cudjoe. Brownphil got involved when he got a quitclaim deed from Earnest and Louis McClendon’s heirs.

Brownphil filed a quiet title action to clear the title of the property, claiming that Cudjoe did not have an interest in the property because Grier Construction was not incorporated at the time it received the property from Earnest and Louise McClendon and because Freddie Grier—the party that granted the property to Cudjoe—was never on the title. Cudjoe argued that he obtained full title by adverse possession.

Interestingly, the special master appointed to the case sided with Brownphil. But, after a hearing, the trial court ruled in favor of Cudjoe.

An appeal followed in which Brownphil argued that Cudjoe had not done enough to establish adverse possession. After receiving a deed from Freddie Grier, Cudjoe paid the property taxes and mowed the lawn. Brownphil argued that paying taxes and lawn mowing are insufficient to gain title by adverse possession.

After reviewing the facts and prior cases, the Georgia Court of Appeals ruled in favor of Cudjoe. The Court of Appeals cited the legal doctrine of “color of title” as the main reason for favoring Cudjoe. Color of title means that someone has a writing (usually a deed) that appears to grant them title. When someone has color of title, importantly, they only have to show seven years of adverse possession and the element of “notoriety” usually required for adverse possession is waived. Notoriety means placing the world on notice that you adversely possess the property. Only having to show seven years and not having to establish notoriety makes it much easier to display adverse possession.

Based on this easier standard, the Court of Appeals found that Cudjoe had shown enough to obtain title to the property through adverse possession.

If you have any questions regarding a quiet title, adverse possession, or color of title, please call us at 404-382-9994.