Help

If you’ve run into a roadblock getting public records in Georgia and need assitance making an open records request, we can help.

What does Georgia Law Say About Open Records?

Under Georgia law, the general rule is that all public records must be open for personal inspection and copying. The only exception are records that are specifically exempted from disclosure. OCGA § 50-18-70 et seq. A good resource is Georgia’s Office of the Attorney General.

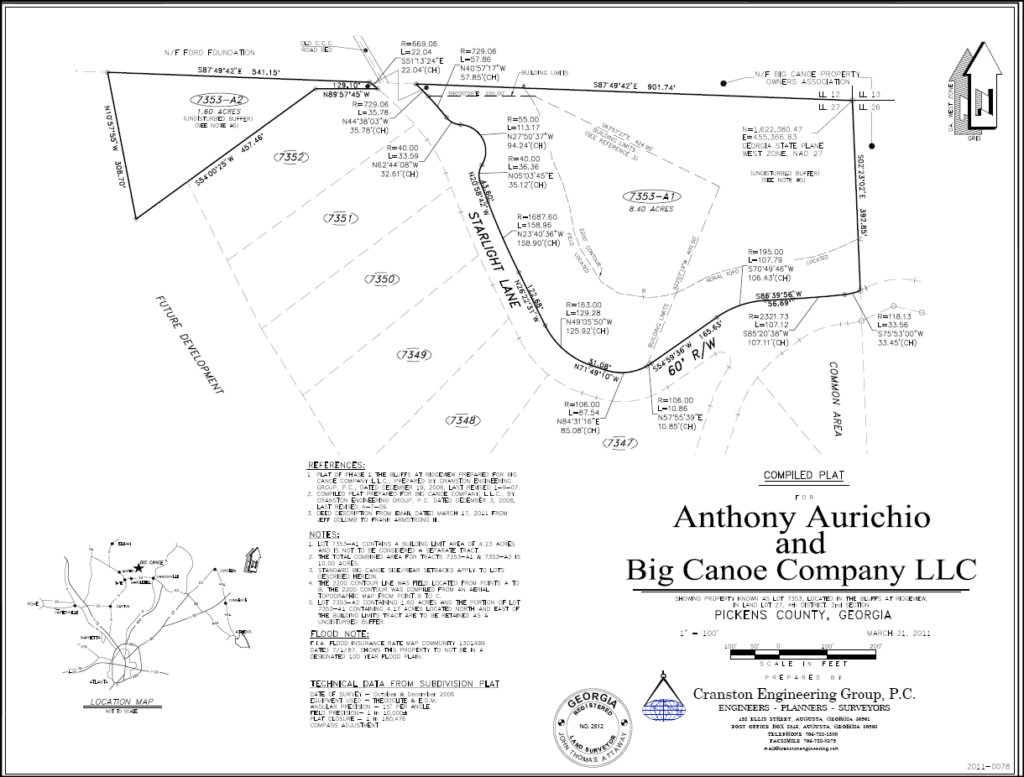

Our office regularly requests open records in Georgia. Some government agencies have dedicated portals, some provide email addresses, and others offer no guidance or contact information. After we make a request, responses are all over the board. Sometimes we get complete records within a few days at no charge. Other times we get notice that the records won’t be ready for eight weeks. Sometimes we get a bill for the records. And often times we get incomplete and overly-redacted records.

Our experience is that most of the time, after the initial request, we have to follow up and fight to get the relevant public records. The government agency’s initial response is usually a result of a minimal effort and often in violation of the spirit of the law.

Purpose of Open Records

The [Open Records Act] was enacted in the public interest to protect the public — both individuals and the public generally — from “closed door” politics and the potential abuse of individuals and the misuse of power such policies entail. Therefore, the Act must be broadly construed to effect its remedial and protective purposes. The intent of the General Assembly was to encourage public access to information and to promote confidence in government through openness to the public and allow the public to evaluate efficient and proper functioning of its institutions.

Wallace v. Greene County, 274 Ga. App. 776, 782 (2) (618 SE2d 642) (2005).

Fortunately, Georgia has detailed open records statutes that government agencies must follow. For example, if public records exist, the government agency must produce the records within three business days of receipt of a request. Similarly, if the records exist and can’t be produced within three days, the agency is supposed to provide the requester with a description of available records and a timeline for when the records will be available for inspection or copying and provide the records or access as soon as practicable. This rule is on the books but rarely followed. Many other rules are too numerous to include here.

What Happens If a Government Agency Fails to Produce Open Records?

The first option is to follow up and try to get voluntary compliance. The second option is to contact The Office of the Attorney General to initiate a mediation. The third and most drastic option is to sue the government agency in superior court. Under Georgia law, a trial court may impose a civil penalty against anyone who negligently fails to provide public records. OCGA § 50-18-74 (a). The courts have interpreted this staute to mean that private citizens (everyday folks) can get damages for violations of the Open Records Act. Cardinale v. Keane, 362 Ga. App. 644 (869 S.E.2d 613) (2022).

Call us!

If you are seeking open records, please call us at (404) 382-9994 to discuss your options.