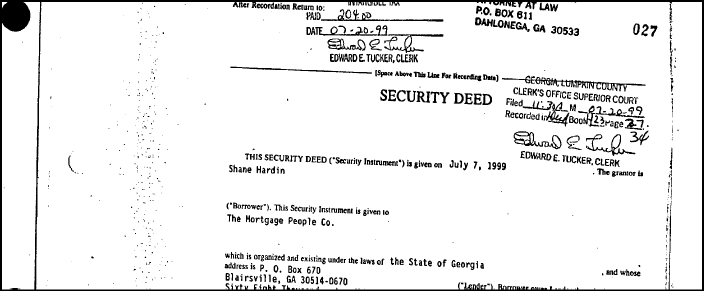

Expiration of Security Deeds in Georgia

We have previously discussed that security deeds (i.e., a mortgage) can automatically expire in Georgia. If a security deed expires, the lender cannot foreclose, and the security deed no longer acts as a lien against the property, and the security deed can be canceled. Generally, under OCGA § 44-14-80, a security deed expires (1) seven years after the maturity date of the security deed, or (2) if there is a statement in the security deed that says the maturity date is perpetual or infinite, 20 years from the date of the conveyance.

Recent Quiet Title Action

The above statute was tested in a recent quiet title action. See Freeport Title & Guaranty, Inc. v. Braswell, A23A0442 (2023). In Freeport, a property owner, A, conveyed real estate to B in 2004. The owner financed the sale, meaning that B borrowed money from A to purchase the property and gave a security deed to A.

B defaulted on the loan, but A did not foreclose on the security deed until 2020. A claimed that the security deed was valid because the security deed has “perpetual/infinite” language and, therefore, the above 20-year rule applied. Conversely, B argued that the security deed (and the 2020 foreclosure) were invalid because the seven-year rule applied.

The Court of Appeals ruled for A, finding that the security deed contained sufficient language to activate the 20-year rule. The Court rejected B’s argument that the language in the security deed was insufficient to show intent for a perpetual duration.

Read the Security Deed

The lesson here is that you must closely read the security deed to determine the expiration date of a security deed. Please call us at 404-382-9994 if you have questions regarding whether a security deed on your property is enforceable and whether you are entitled to file a quiet title to remove the security deed.