Recently, we have seen more judicial tax sales in Georgia. This type of sale is much different than a non-judicial tax sale. OCGA § 48-4-75. Both the procedures and the deadlines differ.

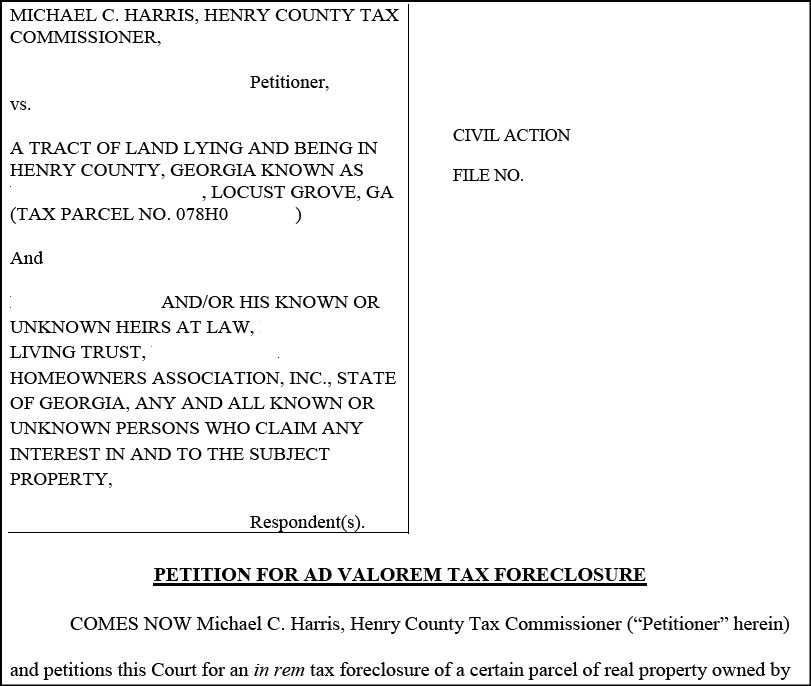

When a taxpayer fails to property taxes, a county may file a judicial-in-rem tax sale. OCGA § 48-4-78. When the county employs this type of tax sale, it files a “Petition” in the superior court. The Petition is against the property itself and anyone with an interest in the property, including the owner.

Once the county files the Petition, the county gives notice to the interested parties. OCGA § 48-4-78. The county posts the property with copies of the summons and Petition, notice to interested parties, and notice of hearing. The county also sends the documents by regular and certified mail to all interested parties. Lastly, the county publishes a legal notice in the county newspaper alerting the public. The notice runs for two weeks).

Following notice, the court holds a hearing. Any interested party has the right to be heard and to contest the allegations in the Petition at the hearing. If the superior court determines that the information in the Petition is accurate and that the county gave proper notice, the court will order the county to sell the property at an auction. OCGA § 48-4-79.

The county then advertises the sale of the property in the county’s legal newspaper for four weeks. The advertisement will show the owner’s name, a description of the property to be sold, and the amount of the tax due OCGA §§ 9-13-140-142.

Before judicial tax sale auction, an interested party may redeem the property by paying the redemption amount to the county tax commissioner. If an interested party pays the redemption amount, the county dismisses the Petition. OCGA § 48-4-80.

One of the main differences between judicial and non-judicial tax sales is that a judicial tax sale allows only 60 days to redeem (buy back the property). In a non-judicial tax sale, the owner has at least one year to redeem. OCGA § 48-4-81.

The other major difference is judicial tax sales vest title absolutely into the purchaser. In theory, this eliminates the need for post-sale barment procedures and quiet title actions. There is little case law to provide guidance, but we expect the courts to consider these issues in the future.