Real Estate Fraud in Georgia

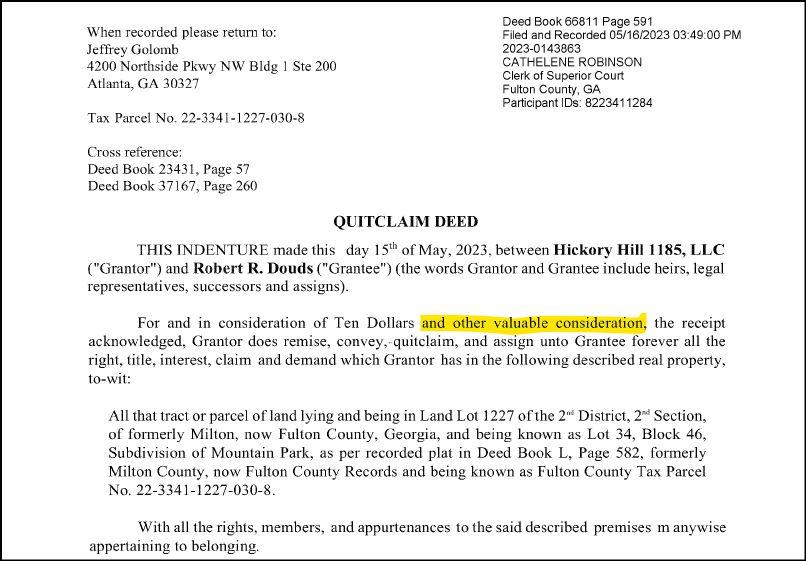

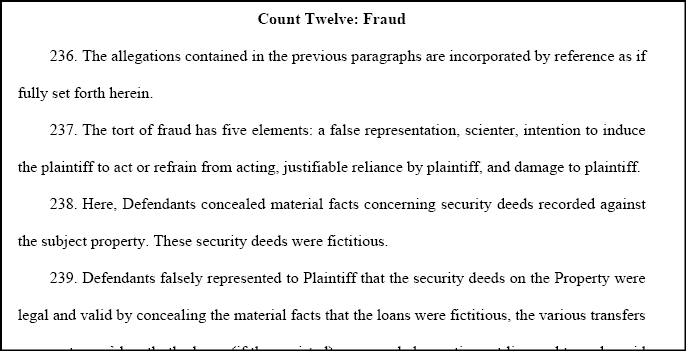

Real estate fraud in Georgia is alive and well. Folks filing fake real estate deeds in Georgia are common. And if you have ever encountered a sovereign citizen, you may have seen some interesting paperwork recorded on Georgia’s public record. Once an improper deed is recorded against your property, it is not always easy to remove and may require filing a quiet title action.

One easy way to combat real estate fraud in Georgia is to register your name with the Georgia Superior Court Clerks Cooperative Authority (“GSCCCA”). These days, most Georgia real estate deeds and documents are recorded using GSCCCA’s online portal. So, to combat fraud, the GSCCCA created a webpage titled the Filing Activity Notification System.

Filing Activity Notification System (a/k/a “FANS”)

To prevent real estate fraud, FANS is a system that allows individuals in Georgia to sign up and receive notifications whenever real estate and personal property records are filed, indexed, and transmitted by Clerks of Superior Court. You can get notifications for all Georgia counties or you can select just one county. So, for example, if someone files a fraudulent quitclaim deed in Bartow County using your name, you will get notified by email or text.

You can opt-in to this system by creating a notification request, which will send an email or text whenever a document in select official county records is filed and index data is entered and transmitted to the GSCCA by the Clerk. The system matches the notification criteria you set up when you register. Notifications are generated for a document filed and index data only for your established parameters.

Notifications

Notifications generated by the system depend upon the index data entered and transmitted by the Clerk of Superior Court in the county of filing. Therefore, it’s not guaranteed that the notices generated by this system will be comprehensive, but it costs nothing and is, therefore, a no-brainer to sign up. With being notified, you may completely unware of the real estate fraud.

Obviously, this system may not work well for you if your name is John Smith. But if your name is less common, like this blog’s author, this system is a great way to protect your real estate proactively. Even if your name is more common, you can limit the counties to only those where you own real estate.